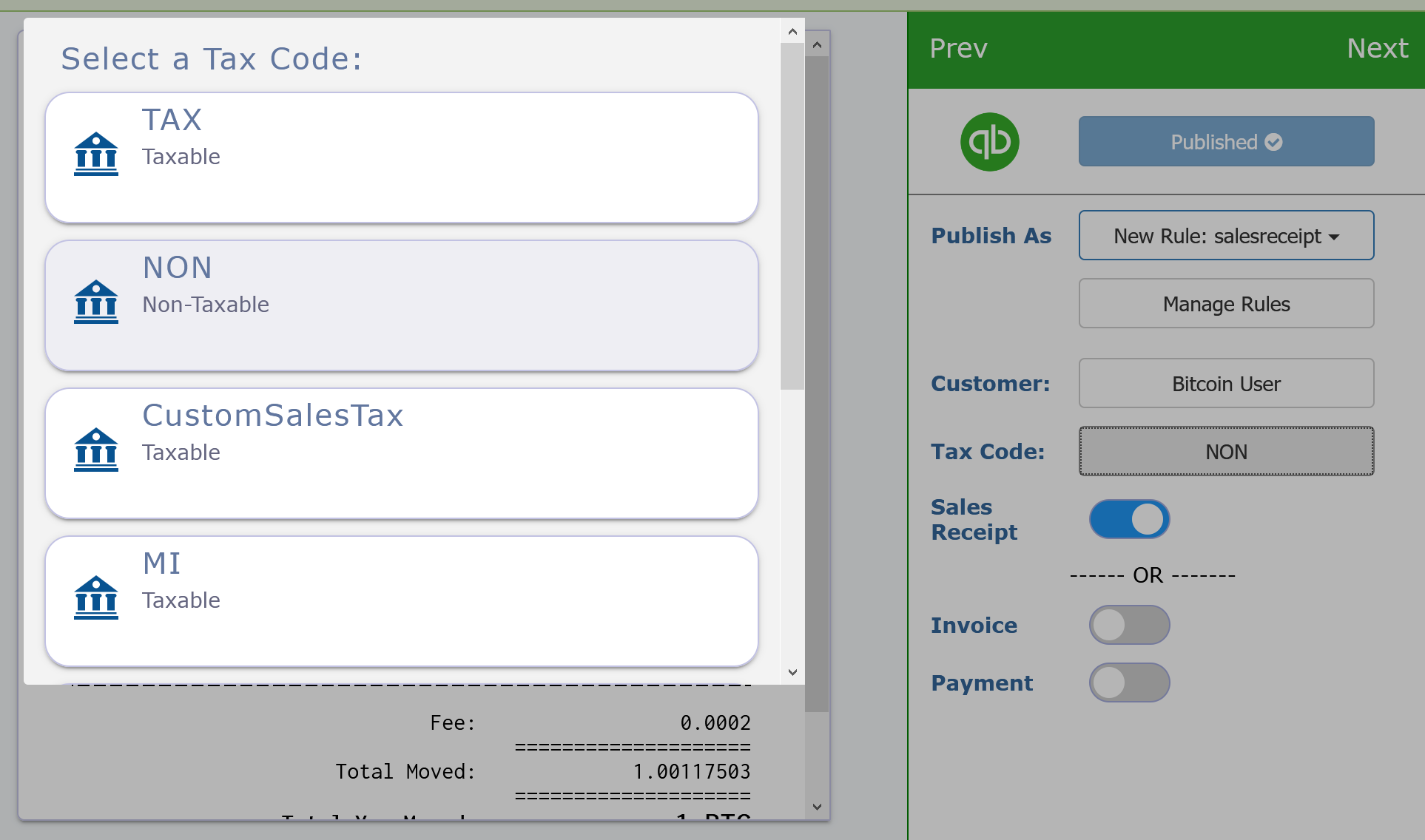

Blockpath now allows you to specify which QuickBooks tax code should be applied to each crypto transaction imported.

Blockpath - Select a Tax Code for the Transaction

These tax codes are synced from sales tax codes you've created within the QuickBooks Tax tab. The tax code can be manually set for each transaction during an individual publish, or you can save the tax code into a Blockpath Rule to automatically apply it in the future.

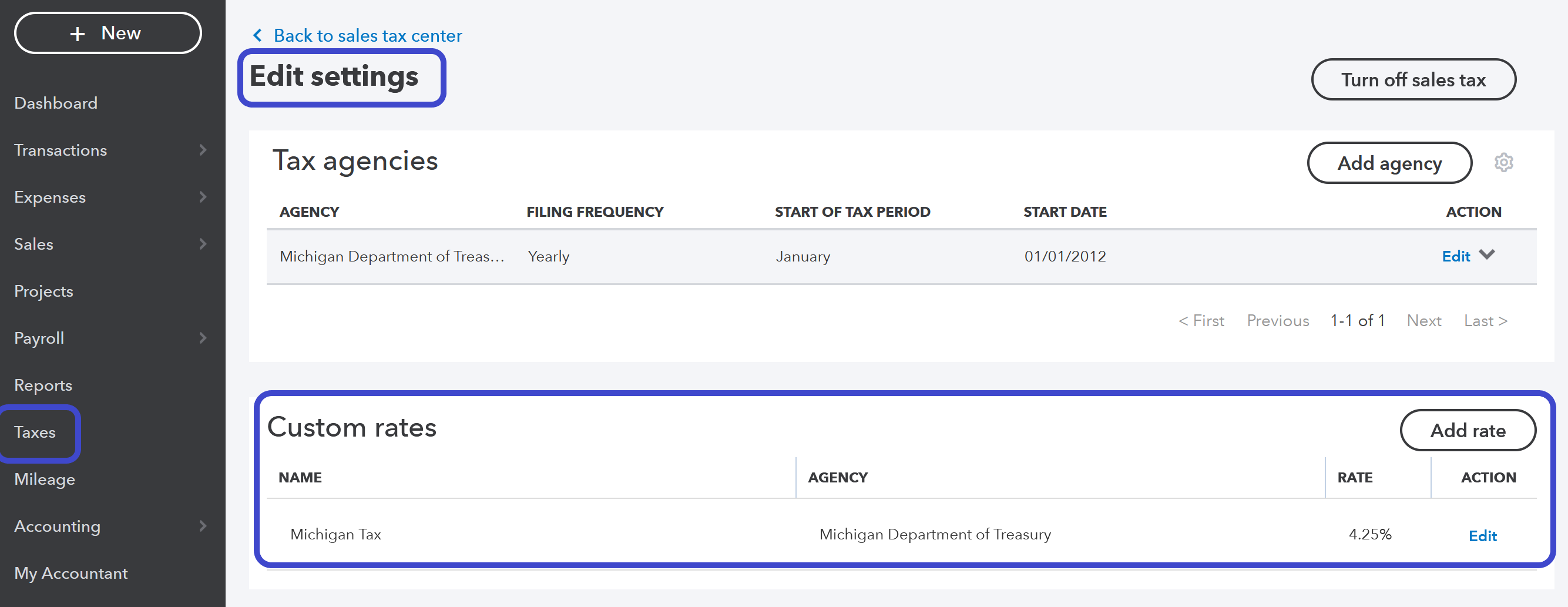

By default, you should simply have TAX (taxable) and NON (non-taxable), but you can create additional tax codes from within QuickBooks and then load them into Blockpath.

QuickBooks - Create Custom Tax Codes

These tax codes will affect your QuickBooks Sales Tax that is calculated by QuickBooks for payments you receive. It will not affect Blockpath's calculations of capital gains tax.

Please be aware, United States QuickBooks users may experience errors when using custom tax codes. For now, QuickBooks seems to require you to only use TAX or NON for our created transactions.

There is nothing here.